No products in the cart.

Business, Curacao Business, Research

THE CURAÇAO MANUFACTURING INDUSTRY – LOCAL OWNED MANUFACTURING AND IMPORT SUBSTITUTION, THE WAY TO A RESILIENT AND THRIVING FUTURE FOR MANUFACTURING IN CURAÇAO

Introduction

The Curaçao Manufacturers Association (CMA), the successor of the Association of Industrialists of the Netherlands Antilles (ASINA), is founded to represent the interest of the manufacturing companies who form part of this industry in Curaçao. In 2018, the CMA drafted an industry agenda with the Curaçao government to support, transform, improve, and promote innovation within the manufacturing industry. To revive the agenda, Deloitte Dutch Caribbean conducted a survey among 16 of the 24 members of CMA in April 2020. The purpose of the survey was to both measure the footprint of the manufacturing industry and the impact of COVID-19 on the sector.

Footprint

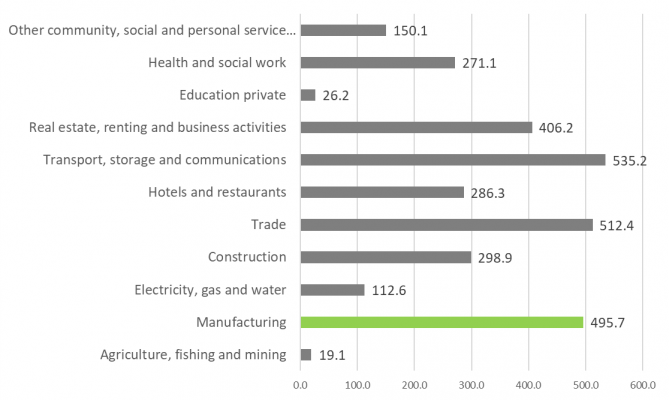

Overall, we can conclude that the contribution of the manufacturing industry to the economy of Curaçao is significant. With a contribution of 9% to the GDP (2018) and a contribution of 6% to the labor market (2018), excluding the energy sector (refinery and utilities), this industry belongs in the top-5 of non-financial industries in Curaçao.

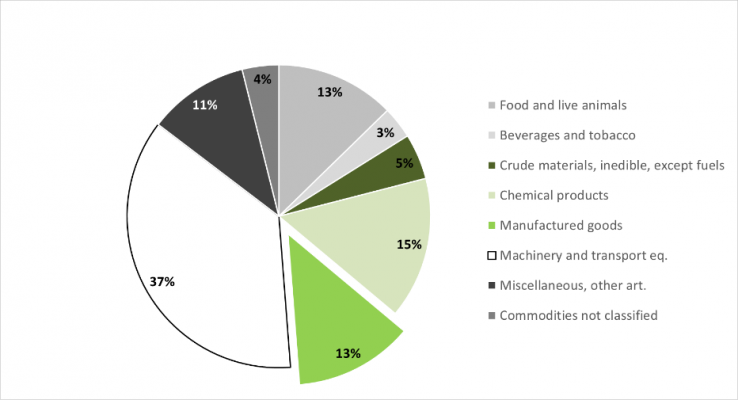

The direct contribution of the manufacturing industry to Curaçao’s export was 13% in 2018. This percentage however is not representative for the goods that are manufactured by the manufacturing industry. This industry is also responsible for manufacturing (and export) of food, beverages, chemical products, etc.

Still, for reasons unknown, this industry is less popular among people looking for work (4.7%) and produces proportionally fewer start-ups (4.5%).

Impact of COVID-19

The impact of COVID-19 on the manufacturing industry was significant. As a direct cause of the closing of the borders in March 2020 and the lockdown in April 2020, the sector’s revenue dropped an average of 69.4% compared to February 2020. More than 50% of the participating CMA members were operational for less than 25% during this period.

With a ratio of 1.35 in 2019, the Debt Service Coverage Ratio (DSCR) of the participating CMA members was above the level of 1.2 which is generally considered as a minimum acceptable level. However due to the abrupt decrease in revenues of 2020, it is expected that many of the participating companies will have more problems to service their debt after the lockdown in April 2020. The cash level in March 2020 showed that on average, companies had enough cash to pay 2.4 months of operating expenses without earning any revenues. Considering this cash ratio, most participating CMA members should be able to overcome the lockdown of April but will have difficulties in covering their operational expenses. However, if a new lockdown becomes necessary due to a second wave, liquidity can become a critical issue for certain CMA members.

Looking forward

While the primary focus of the government is on tourism, the refinery and the financial sector, the manufacturing industry believes it can be a more substantial contributor to the economy, employment, and foreign exchange generation. Focusing on the future, the CMA must become a more important stakeholder of the government as an interest representative of local manufacturers.

The manufacturing industry has not yet developed a suitable strategy to the ‘future of work’. Although diversity and talent form part of the strategic goals of the CMA, this has not resulted in concrete action or results. There is a lot of potential in increasing competitiveness through investment in innovation, new technologies, automation, AI, and robotics. These, together with supply chain improvements, are areas in which the industry can improve (cost) competitiveness, and resilience to future disruptions in the short and long term.

Recommendations

Recommendation 1 and 2: Determine desired skill set that is needed in the manufacturing industry in order to shape the workforce of the future. Join forces with government’s educational policy makers and the educational sector in closing the gap between the current curriculum and the desired skill set.

Join forces with government’s economic and educational policy makers and the educational sector in providing education that promotes and stimulates entrepreneurship.

Recommendation 3: Seek out partnerships with universities and institutions of higher education in Europe and America to set up specific traineeships with students in order to attract talent and at the same time increase the innovative strength of manufacturing companies. When seeking out talent for traineeships, local students studying abroad should be targeted specifically.

Recommendation 4: Invest in current workforce and leadership by organizing and facilitating specific training to: (1) further shape the workforce to meet the desired skill set; (2) develop innovative skills of the workforce; and (3) develop leadership skills that enables innovation-stimulated leadership.

Recommendation 5 and 6: Invest in new technologies, automation, AI, and robotics. Join forces in the manufacturing industry to investigate best practices for automating back office processes on short term.

In order to realize long term development in this area, join forces with government and the financial sector to develop incentives and subsidies to finance investment for implementation of new technologies, automation, AI, and robotics in primary manufacturing processes. This adds to cost effectiveness and makes the industry more attractive for tech-savvy talent.

Recommendation 7: Join forces with government’s economic policy makers in order to develop a strategic import substitution strategy and roadmap for Curaçao. This strategy should be focused on facilitating, stimulating, and promoting the local business in order to generate import substitution without creating market protection or import barriers. The focus should be on increasing local production, creating more diversity in locally manufactured goods, increasing quality of locally manufactured goods, and lowering the costs of doing business. These measures will also directly increase the competitiveness of Curaçao in growing exports.

Recommendation 8: Join forces with government to conduct an extensive study in the complexities of supply and distribution chains for critical goods. Data analytics will provide the necessary insight in the supply chain and will help to make sound policy and business decisions. Greater visibility and coordination across the supply chain will provide valuable insight to work on import substitution, improving cost competitiveness and build a resilient supply chain.

Recommendation 9: Government should be requested to address the current tax regimes in order to stimulate and support local manufacturing, keeping in mind the sector’s impact on local employment, import substituting products and generation of foreign exchange from export. A comprehensive tax supporting regime especially designed for local manufacturers should be prepared which should at least include:

- Local manufacturing should be assigned as one of the domestic activities which are taxed at a reduced profit tax rate of 3%;

- A more favorable investment deduction of 20% in the first and 10% in the second year of acquisition for investments made in tangible fixed assets which are durable/energy saving;

- The sales tax ordinance should be adapted in order to exclude all indirect taxes from the cost of the locally produced goods;

- Tax holidays should exclude exemptions for goods which are locally produced, or even include as one of the requirements that a certain % of the investment must include the locally produced goods in order to get a longer or more favorable tax holiday;

- The possibilities of the Caribbean Basin Initiative should be further investigated; where possible, an introduction plan and guidance should be developed.

Recommendation 10: Join forces with government on developing a durable energy policy that lifts the cost competitiveness of the manufacturing industry, resulting in lower electricity rates and lowers the cost of doing business. Growth of the manufacturing sector will directly benefit the utilities sector.

Deloitte Dutch Caribbean and its multi-disciplinary teams can support your organization in a wide variety of services. For more information, please visit our website https://www.deloitte.com/an/ or reach out using the contact below.

Managing Partner Curacao | Tax

Menno George

Senior Manager | Strategy & Operations

mennogeorge@deloitte.cw